4Q22 Results, as of December 31, 2022

2022 has ended, but the bear market – and need for risk management – remains!

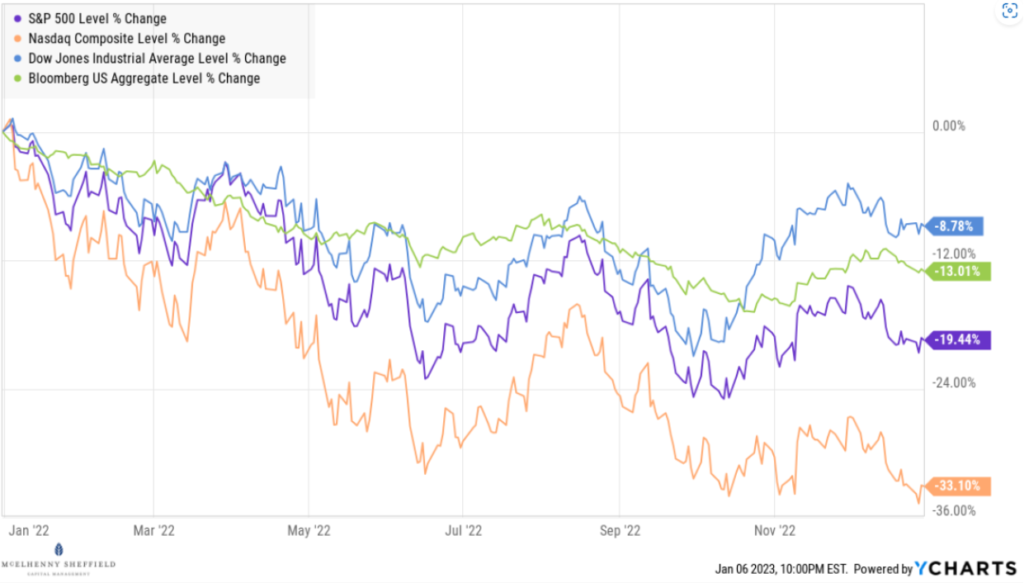

2022 ended with the stock market delivering its largest yearly losses since 2008. The 4th quarter of 2022 saw new bear market lows in the S&P 500, Nasdaq, and Bloomberg Agg Bond Index.

- The S&P 500 finished the year down 19.44%, after being down nearly 25% at its lowest point in the year on October 12th.

- The Nasdaq finished the year down 33.1% with its lowest point being down almost 35% on December 28th.

- The Dow dropped in December to finish the year down 8.78%.

- The Bond index finished down 13% for its worst calendar year performance in many decades.

- A traditional allocation of 60% stocks and 40% bonds was down approximately 17%.

The main theme driving markets in 2022 was inflation; it’s causes, how long it would persist, and how the Fed would respond to it. The Fed moved in historic fashion to raise interest rates, making seven consecutive rate increases totaling 425bps, but inflation is still too high, and the Fed has stated more rate increases are needed and that rates would be held higher for longer to get inflation to their desired goal of 2%. The rapid monetary tightening aimed at bringing down inflation will ultimately succeed, but the cost will likely be a global recession in 2023. The story for 2023 will continue with inflation as the main theme but will soon be dominated with talk of a recession.

The drop in the stock market during 2022 improved equity valuations some, but the market is still overvalued by most estimates. The growing likelihood of a recession is a big risk to corporate earnings, as a recession would mean revenues decline, and profit margins compress from their current cyclical-high levels. Another leg down in the stock market (and possibly the bottom of the bear market) may come as companies reevaluate their earnings expectations to account for a global recession.

Given the high likelihood of a recession, active investors may feel sitting in cash is their best option right now, but without a disciplined approach for re-allocating capital when the investing environment improves, most investors will inevitably stay in cash far too long and miss out on the growth potential that comes after bear markets. We think the better approach is to invest using the MSCM risk-managed strategies, which can participate in market upside when appropriate, while always maintaining downside protection if this bear market worsens.

Models

TREND PLUS

The Trend Plus strategy was down 9.9% in 2022, ahead of the S&P500, Nasdaq Composite, traditional 60/40 allocations, and even down less than the U.S. bond benchmark for the year. After the early January 2022 move defensive, the strategy attempted to participate in several of the counter-trend rallies that occurred during the year, but each bear market rally eventually failed and Trend Plus was stopped out to avoid riding the market to lower levels. Risk management and downside protection are critical to generating long-term performance and we know we can come out ahead by minimizing drawdowns in the bad markets. The graph below shows the times at which Trend Plus was invested in the market (green) versus positioned defensively (red). Even though the model suffered a few whipsaw trades, the ability to avoid the large down moves in the market kept us ahead.

SECTOR ROTATION

The Sector Rotation momentum strategy was down 13.7% in 2022, well ahead of the S&P500, Nasdaq Composite, and traditional 60/40 allocations. Sector Rotation also only had a drawdown during the year of 15.5% (peak-to-trough move), while at one point the S&P 500 had lost a full quarter of its value (down 25% in October). Drawdowns are painful to investors and reducing the magnitude and duration of drawdown periods ultimately provides a smoother ride for our clients. The strategy did not suffer any whipsaw trades since moving defensive in February. The defensive positions have had mixed performance with U.S. Dollar showing strength while gold lost ground for most of the year, while during the 4th quarter gold established itself in an uptrend and was additive to the strategy returns.

The strategy remains defensive with no equity exposure and will protect client accounts if a further selloff is experienced in the stock market.

TPSR (50% Trend Plus & 50% Sector Rotation)

The TPSR strategy was down 11.7% in 2022, well ahead of the broad market that was down more than 19% and traditional 60/40 portfolios that were down 17%. Having exposure to both Trend Plus and Sector Rotation strategies has provided good results during a tough market environment, ultimately beating benchmark returns through superior risk management. This blended strategy has the ability to be reactive to changing market conditions and allocate quickly if a market rebound occurs, while still focusing on moves defensive to protect client capital if the bear market worsens.

Summary

We have stated many times in our investor updates that nobody can know if the bear market is over until the market attains new all-time highs. Allocating investors’ capital based on guesses that the “bottom is in” is foolish and a recipe for disaster, although many take this approach. Our approach is very different and, we think, a much better way to invest client assets. Our disciplined, rules-based, quantitative approach to investing is robust, has been time-tested, and has delivered outstanding results across many market environments – including protecting investors from significant drawdowns this past year.

We will attempt to participate in market rallies when they occur, but always with a focus on risk management and downside protection. Compounded returns over time are greater if smaller losses are taken during bear markets and that is what our strategies delivered in 2022.

We feel strongly that all investors should have an allocation to tactical strategies such as ours to improve their overall portfolio performance and make it through bear markets more successfully. Please contact us if you have any questions about our strategies or how MSCM can play an important part in your investment management plan.

Our strategy sheets are accessible through the buttons below, and on our website mscm.net.

McElhenny Sheffield Capital Management, 4701 W. Lovers Lane, Dallas, Texas 75209, 214.922.9200