Send us a message with your questions.

For the past 13 years, investors have been the beneficiaries of an incredible run in the U.S. stock market. The S&P 500 Total Return index finished 10 of the past 13 years above 11%! Even in an arguably tough economic environment over the last 3 years, the index has averaged over 26% per year.

Header | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

S&P 500 | 26.5% | 15.1% | 2.1% | 16.0% | 32.4% | 13.7% | 1.4% | 12.0% | 21.8% | (4.4)% | 31.45% | 18.4% | 28.7% |

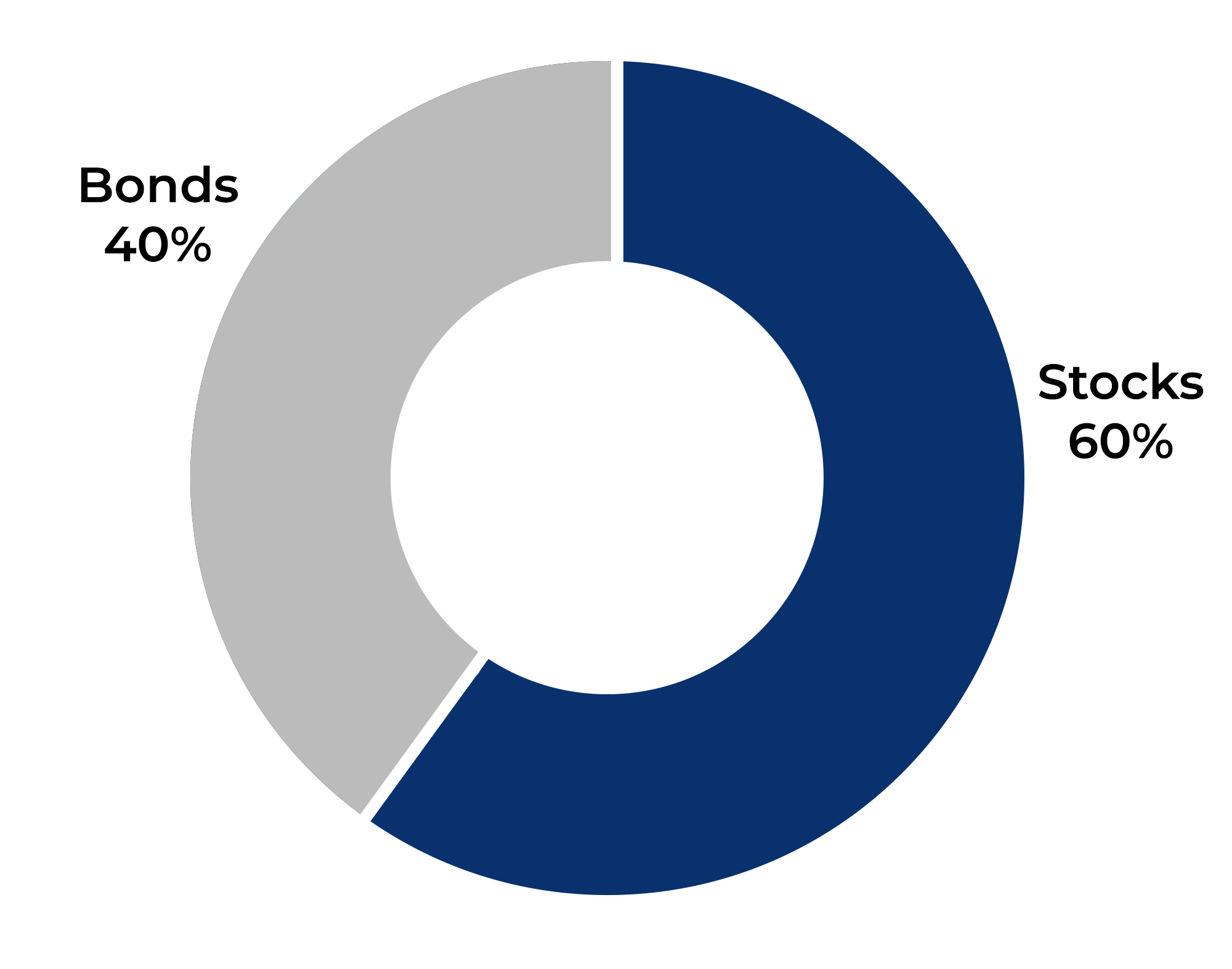

The traditional 60% stock and a 40% bond (60/40) portfolio has helped investors meet or exceed their financial goals over the past decade. While the bond allocation has not been a large driver of returns, it has served an important purpose to investors. Using bonds as a diversifier to stocks helped to de-risk the portfolio and, in the falling rate environment we've seen over the last decade, was still additive to a portfolio returns. This has been the best of all worlds from an investing standpoint!

Most advisors tweak the standard 60/40 portfolio to make it their own and customize it for their clients. This may include adjusting the asset class weighting, adding international, stocks, real estate, or commodities, or tilting factor exposures. Advisors use an endless number of combinations in the hopes of driving better performance; wanting the same or better returns with less risk.

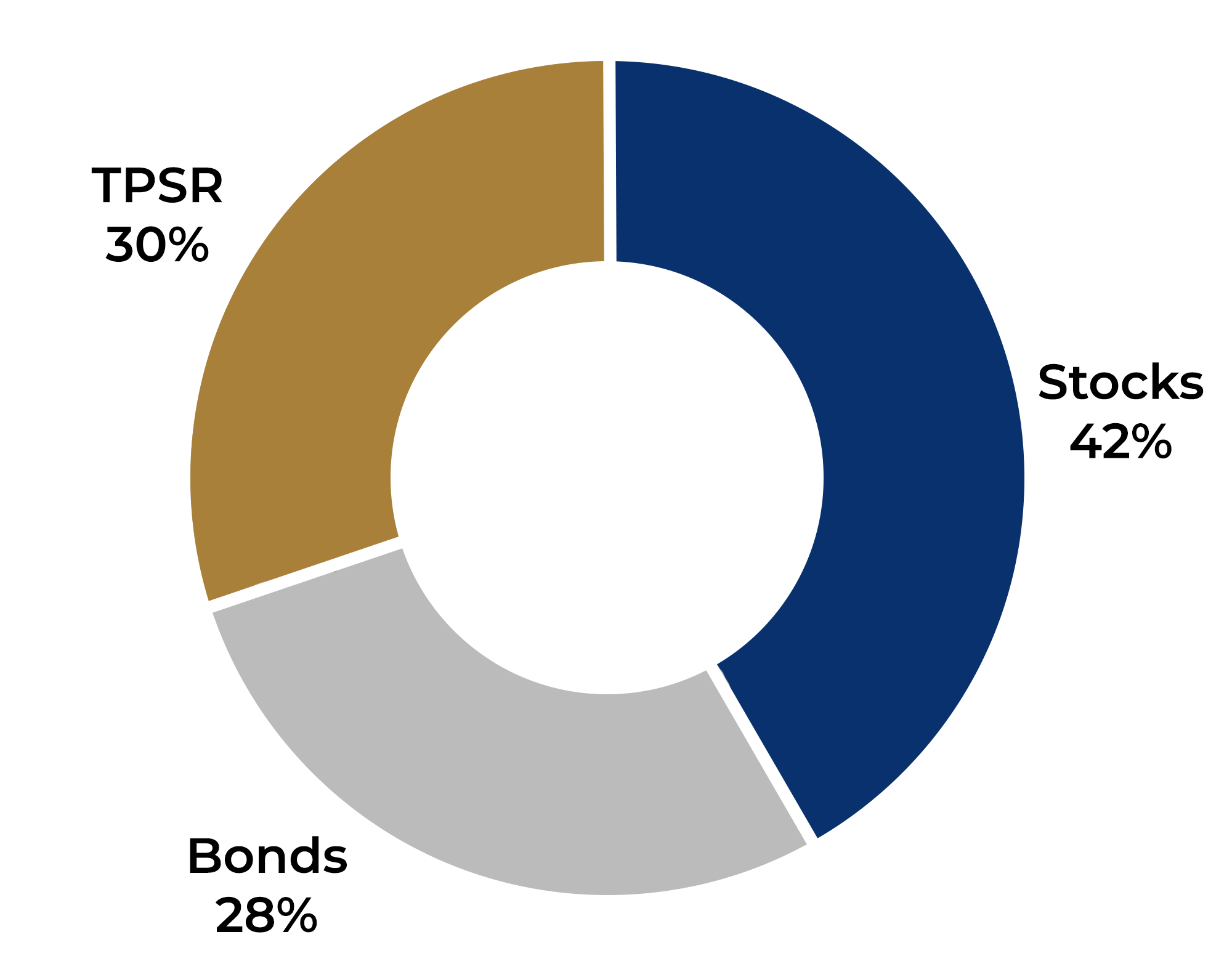

Notably, to lower the overall risk of a portfolio, advisors seek diversification across asset classes and geographies. Yet, a very easy but often overlooked diversification tool that can provide tremendous portfolio benefits is diversification across the types of investment strategies being used. MSCM's Advisors prefer tactical investment strategies for this type of diversification. Tactical strategies are those that do not keep the asset class weighting constant over time and can fluctuate from being 100% invested in stocks to being 0% invested in stocks (i.e., fully defensive).

Below is a comparison of a traditional 60/40 portfolio alongside a similar portfolio that adds a 30% allocation to our TPSR tactical strategy. Note that the TPSR allocation can come from the entire existing portfolio, not just the stocks allocation, because tactical strategies generally have risk profiles better than existing 60/40 portfolios; historically TPSR has reduced drawdowns and improved returns (more on this below).

All multi-year periods improved by adding an allocation to tactical

Additionally, all risk metrics improve by adding a tactical allocation in your portfolio. This creates a safer, higher returning portfolio. Unique diversifiers that can improve returns AND lessen risk are generally either very hard to find or too expensive to use in a portfolio for most clients…TPSR changes that for MSCM's clients.

The last 13 years have been great, but let’s look at what is ahead. Unfortunately, most major financial institutions are calling for much more subdued returns going forward. The surprising figures below are taken from the capital market assumptions of the constituent institutions. For context, the S&P 500 has averaged 16.3% since 2009 and is now expected to return at the very best 7% annually.

Institution | U.S. Equities | U.S. Aggregate Bonds |

|---|---|---|

Vanguard¹ | 2.3%-4.3% | 1.4%-2.4% |

Blackrock² | 6.7% | 1.6% |

BNY Mellon³ | 5.9% | 1.2% |

JP Morgan⁴ | 4.1% | 2.8% |

Research Affiliates⁵ | 4.3% | 2.1% |

Invesco⁶ | 7.0% | 1.9% |

Average | 5.21% | 1.92% |

The unwritten presumption in these projections is that the next decade will include at least one big bear market. Think about it. To accomplish JP Morgan’s 4.1% projected annualized equity return, it is highly unlikely that the U.S. stock market returns 4.1% for each of the next 10 years. We will surely have years with great returns, years with ok returns, and years with terrible returns. The year (or years) of terrible return is what causes the average to be so low.

If these projections are remotely correct, reaching your retirement goals with a 60/40 portfolio will become significantly harder if not impossible. A tactical strategy, like TPSR, will likely help capture the gains of the great bull markets and attempt to sidestep the losses of the upcoming big bear market.

We suggest that all investors add an allocation to TPSR to their portfolio. We want to make sure clients are positioned correctly for the road ahead. Even if the prognosticators are wrong about future returns, our evidence suggests that using TPSR should still enhance the risk-return profile of your portfolio.

¹

Market perspectives: December 2021 (vanguard.com)

²

Capital Market Assumptions | BlackRock

³

Our 2022 Capital Market Assumptions | BNY Mellon Wealth Management

⁴ Long-Term Capital Market Assumptions | J.P. Morgan Asset Management (jpmorgan.com)

⁵

Asset Allocation Interactive (researchaffiliates.com)

⁶ invesco-capital-market-assumption-2022-usd.pdf